income tax plus capital gains tax

Just a small change in your income can make a pretty significant difference. With the 25100 standard deduction common for joint filers the couples taxable income drops to 74900 which is below the 80800 threshold for 0 long-term capital gains tax.

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Short-term capital gains are gains apply to assets or property you held for one year or less.

. Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide. For 2022 the 0 long-term capital gains tax rate applies if your income is 41675 or less 15 if you have income of 459750 or less and. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains.

Establish the date you buy or acquire an asset your share of ownership and records to keep. In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single tax filers with taxable incomes up to 40400. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household.

A Guide to Understand Your Options With RSUs Deferred Comp Plans More. There can be years when youll have less taxable income than in others. Short-Term Capital Gain.

The threshold is slightly higher for heads of household and twice as much for. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for single or 80800 for married filing jointly or qualifying widow er. Long-term capital gains apply to assets that you held for over one year and are taxed differently.

If for one or either you have a loss then you might be eligible to deduct 3000 from your taxable income for the year. If your taxable. H eld for 1 year or less.

Wednesday June 22 2022. They are subject to ordinary income tax rates meaning theyre taxed federally at either 10 12 22 24 32 35 or 37. Short-term capital gain tax rates.

4 rows The capital gains tax on most net gains is no more than 15 for most people. Meaning of Capital Gains Profits or gains arising from transfer of a capital asset are called Capital Gains and are charged to tax under the head Capital Gains. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

The tax rate on most net capital gain is no higher than 15 for most individuals. Someone making 41000 in taxable income might not pay any long-term capital gains taxes at all while someone with 42000 in taxable income. Then the tax on those capital gains and dividends are computed but the ordinary income after subtracting itemized or standard deduction above the cutoff for the filings status of the return.

10 12 22 24 32 35 or 37. Capital gains tax rates on most assets held for a year or less correspond to ordinary income tax brackets. Income tax plus capital gains tax.

The first capital gains tax was introduced along with the first federal income tax legislation in 1913. The way it works is that taxes are calculated on your ordinary income including short-term capital gains as if there were no Qualifying Dividends or Long-term Capital gains. Taxed at 0 15 or 20 depending on your income.

Long-term capital gains tax rate. Check if your assets are subject to CGT exempt or pre-date CGT. Held for more than 1 Year.

Each bucket is taxed differently. Then the tax on those capital gains and dividends are computed but the ordinary income after subtracting itemized or standard deduction above the cutoff for the filings status of the return. You can find the 2022 rates here.

Capital gains tax rates have fallen in recent years after peaking in the 1970s. In this part you can gain knowledge about the provisions relating to tax on Long Term Capital Gains. History of capital gains tax.

Taxed at Ordinary Income Tax Rates. Short-term capital gainsfrom assets held for a year or lessare taxed as ordinary income at rates up to 37 percent while long-term capital gains are taxed up to 20 percent. Income from capital gains is classified as Short Term Capital Gains and Long Term Capital Gains.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. How and when CGT is triggered such as when an asset is sold lost or destroyed.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Money Isn T Everything Capital Gain

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Types Exemption And Savings Forbes Advisor India

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Tax Calculator Estimate Your Income Tax For 2022 Free

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Tax What It Is How It Works Seeking Alpha

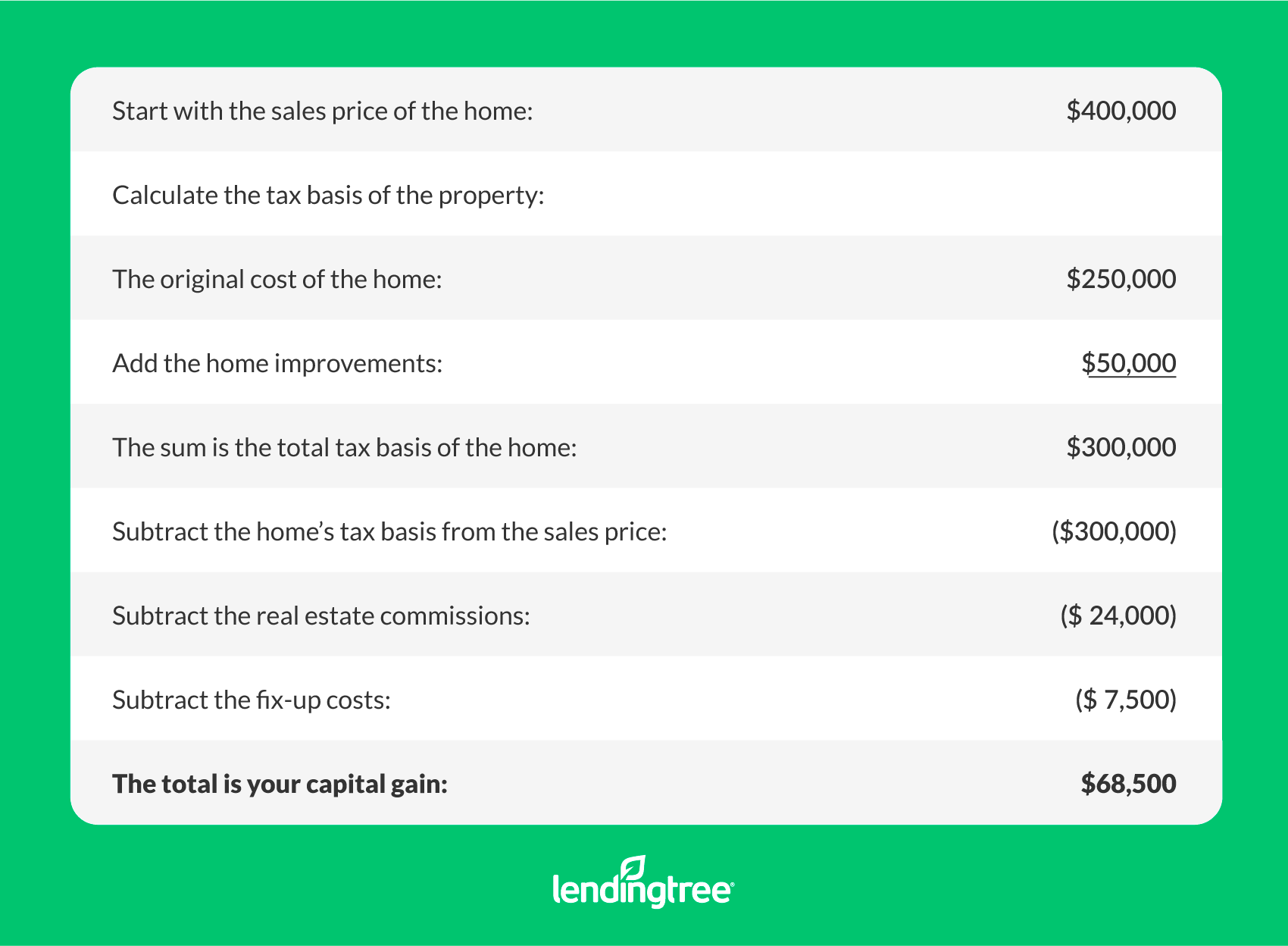

Capital Gains Tax On A Home Sale Lendingtree

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)